GLEICHSCHALTUNG [Pronounced: ˈɡlaɪçʃaltʊŋ, or (roughly) glike-shawl-toong]

1. A term which originated in Nazi Germany and referred

to the process of the complete Nazification of the economy, politics, media, education, culture and the

entire German society. Anything in any way opposed to Hitler and Nazism was systematically eliminated in

all spheres through a combination of new laws and violence. So the word means something along the lines of

the coordination, systematization, synchronization, or unification of everything to come into full

agreement with Nazi ideas and policies. This full control was achieved through a combination of new laws,

government police forces, and organized Nazi party violence, that dissolved opposing groups, removed

individuals from power, and enforced participation in Nazi-controlled organizations.

[Origin:] The word itself is a compound formed from

“gleich” (same) and “schaltung” (circuit). It apparently derives from an electrical engineering term where

all switches are connected to the same circuit, allowing them to be activated by a single master switch.

2. [In America starting in 2025:] The current attempted

application of this same sort of systematization, domination and total unification of all ideas and policies

to now come into alignment and total agreement with the new authoritarian ideas and policies of Donald Trump,

starting with the beginning of his second term as President in January 2025. Many opponents of Trump and

his fascist-like program have recognized that what he and his movement are up to now is very much along the

lines of the Gleichschaltung as it began in Germany under Hitler in 1933, and is focused on the

complete elimination of any expression or act of disagreement or opposition by anybody.

“[Regimes of the fascist genus], once they have gained control of the executive

branch of the state, whether by election or coup, do not rule simply through raw power, but cling

to some notion of legal order as the basis of their rule, claiming to conform to a constitutional

order. What would normally be considered extralegal coercion is justified in terms of various

‘states of exception’ such as the declaration of a ‘national emergency’ or martial law, along with

the introduction of a leadership principle enhancing executive authority, allowing the usual

constitutional barriers to be crossed. This process, however, requires the support or acquiescence

of the larger society. Hence, consolidation of such regimes is not the work of a day. Full dominance

can only be achieved through a lengthy process that in Nazi Germany was known as Gleichschaltung,

meaning synchronization or falling into line, whereby the entire state apparatus and the larger

cultural apparatus are brought step by step under the regimes control.

“In the destruction of the liberal democratic state,

a fascist or neofascist movement needs to gain control of the executive, legislative, and judicial

branches; the administrative state or civil service bureaucracy; the military and national security

system; and, below the national or federal level, regional and local governments. However,

Gleichschaltung does not stop with the conquest of the state apparatus but necessarily extends

to the entire cultural apparatus of society, including the media, the educational system as a whole

(both public and private), the wider legal sphere (lawyers and law schools), trade unions, the

sciences, and the arts—eliminating all areas of critical thought and potential opposition.

“In Nazi Germany, Gleichschaltung began with

the introduction of the Law for the Restoration of the Professional Civil Service in April 1933,

shortly after Adolf Hitler’s rise to power. This law allowed for the firing of all ‘non-Aryans’ or

Jews and all political opponents (principally Communists and socialists more generally from the civil

service, including judges, professors, art museum directors, teachers, musicians, and conductors—and

immediately extended to the practice of the professions in general, for example, lawyers and notaries.

The aim was to gain complete control over civil society—all the way to the creative arts. In the

words of Hitler in Mein Kampf, ‘The purification of our civilization must include almost every

field. Theatre, art, literature, cinema, press, posters, and displays must be cleansed of exhibitions

of a world in the process of putrefication, and be put in the service of a moral idea, a principle of

State and civilization’ (Adolf Hitler quoted in Jean-Michael Palmier, Weimar in Exile: Antifascist

Emigration in Europe and America [London: Verso, 2017], 23).

“Gleichschaltung in Germany was carried out

mainly in the first two years of the Nazi regime. An example in the universities can be seen in the

appointment of the philosopher Martin Heidegger, the official Nazi choice, as rector of the University

of Freiburg in April 1933—at the same time as the passage of the Law for the Restoration of the

Professional Civil Service. Heidegger introduced the Nazi salute at Freiberg, and denounced

intellectuals he disliked to the Gestapo as friends of the Jews, leading to their removal. In his

inaugural address as rector, he presented the Führerprinzip (Führer principle),

promoted by the Nazi jurist Carl Schmitt, according to which, in Heidegger’s words, ‘The Führer

himself and he alone is the German reality, present and future, and its law’ (Karl Dietrich Bracher,

‘Stages of Totalitarian “Integration” [Gleichschaltung]: The Consolidation of National

Socialist Rule in 1933 and 1934,’ in Republic to Reich ed. Hajo Holborn [New York: Vintage,

1972], [and other sources]...”

—“Notes from the Editors” [John Bellamy Foster],

Monthly Review, Vol. 77, No. 2, June 2025, inside covers. [Foster includes further material

here about how Gleichschaltung worked in early Nazi Germany.]

GLOBAL DEBT

Capitalism can only function through the continual expansion of debt: consumer debt, business debt,

and government debt. The most basic reason for this is that those who actually produce wealth (the

working class) are only paid in wages for a fraction of the wealth they produce, and therefore—as

consumers—can only buy back all that they produce by going ever deeper into debt. Growing business

and government debt, though not quite as logically necessary, also become indispensable in practice

to a great degree. (See: Keynesian Deficits). Consequently,

in the entire capitalist world, and in between the catastrophic financial collapses during major

capitalist overproduction crises, debt must continue to

grow, and to grow at a generally ever increasing pace.

In major countries this expansion of debt becomes

enormous. And on a world scale it eventually becomes truly colossal! According to the Institute of

International Finance, based in Washington, D.C., global debt reached $246.5 trillion in

the first half of 2019. This is 318 percent of the world’s annual GDP. This comes to $32,500 for

every man, woman and child on earth! Of this grand total, the collective debt of the advanced

capitalist countries is $177 trillion, and the debt of the “developing nations” is about $69

trillion. These amounts are very near to the limit that is possible even under the wild debt growth

typical of (and necessary to) capitalism. It strongly suggests that a new world financial crisis is

very near, and one leading to a new world capitalist depression.

[After citing the global debt figures mentioned above, the economist Alexander

Losev continues:]

“However, despite the unprecedented growth

of world debt in the past ten years after the 2008 crisis, investment activity in the real

economy is declining, growth in the world economy and international trade is slowing and the

risk of a global recession is on the rise. The accumulated aggregate debt is becoming a real

threat to the stability of the global financial system.

“Credit financing has become the main, if

not the only means of maintaining global consumer demand and a major impetus for the growth of

stock markets and economic advance in general. The post-industrial model with a high level of

automation and the transfer of production to countries with cheap labor and [the transfer of]

profit centers to tax havens has led to a sharp decline in the share of human labor in the end

product. Now owners of capital and means of production share much less with their workers and

states. [I.e., much less of the total value added by production now goes to wages and taxes.

—Ed.] Under the circumstances, governments must continuously increase their national debt to

finance budget deficits, while the population has to take out loans to maintain existing living

standards because of falling revenues.

“Another problem is that now global debt

is growing faster than the world economy, and each new percent of economic growth is matched

by an additional increase in the aggregate debt by 1.5 to 2 percent. Deceleration of credit

financing for various reasons, including a decline in economic activity due to trade wars, a

shortage of liquidity and/or interest rate increases could instantly lead to the stagnation

of the world economy. It is only the incredibly soft money-and-credit policy of the world’s

major central banks that is keeping the entire economic and financial system afloat at this

point.

“The International Monetary Fund (IMF)

noted that corporate debt-at-risk could rise to $19 trillion. In its half yearly report on

the condition of world financial markets, the IMF warned that it will be impossible to

service almost 40 percent of the corporate debt in the eight leading countries—the United

States, China, Japan, Germany, Great Britain, France, Italy and Spain. The IMF notes that

adaptive money-and-credit stimulation by central banks has helped companies accept financial

risk, which led to ‘alarming’ debt levels with low loan quality.

“It will be impossible to continue to

expand loan capacity....

“The unprecedented debt load of major

economies, like the United States, China and the EU is fraught with a disastrous threat for

the entire world. This could lead to a disaster that will by far exceed the Great Depression

if deleverage starts. In effect, this happens when a credit bubble bursts. A deleverage could

happen not because banks will run out of money for new loans but because borrowers may not

have an opportunity to refinance debt and redeem loans. As the 2007-2008 America mortgage

crisis showed, defaults totaling $1.3 trillion could trigger a domino effect with mass-scale

bankruptcies and blowout sales of collateral that’s rapidly losing its value.

“Since the global debt has reached $246.5

trillion, neither governments nor central banks will have enough resources to repurchase

liabilities and write off debt as they did during the 2008 crisis when they helped banks,

pension and investment funds, companies and individuals that were rapidly losing assets. In

addition, considering that the market for currency and loan derivatives exceeds $600 trillion

(about $545 trillion in the United States alone), it’s clear that there are several ticking

bombs.

“It is only a matter of time before a

disastrous crisis makes the Great Depression of the 1930s and the 2008 recession seem mild.”

—Alexander Losev, “Is There a Threat of

a New Global Economic Crisis?”, speaking at the Valdai Club (a Russian ruling class discussion

group), Nov. 14, 2019, online at:

http://www.valdaiclub.com/a/highlights/is-there-a-threat-of-a-new-global-economic-crisis/#

GLOBAL FINANCIAL MARKETS

“After the fall of Lehman Brothers 10 years ago, there was a public debate

about how the leading American banks had grown ‘too big to fail.’ But that debate overlooked

the larger story about how the global markets where stocks, bonds and other financial assets

are traded had grown worrisomely large.

“By the eve of the 2008 crisis, global

financial markets dwarfed the global economy. Those markets had tripled over the previous

three decades to 347 percent of the world’s gross economic output, driven up by easy money

pouring out of central banks. That is one major reason that the ripple effects of Lehman’s

fall were large enough to cause the worst downturn since the Great Depression.

“Today the markets are even larger,

having grown to 360 percent of global gross domestic product, a record high. And financial

authorities—trained to focus more on how markets respond to economic risk than on the risks

that markets pose to the economy—have been inadvertently fueling this new threat....

“To have any chance of anticipating

and preventing the next downturn, regulators must look for the threats that have emerged

since 2008. They need to recognize that the markets now play an outsized role in the

economy, and their attempts to micromanage this vast sea of money have only pushed the

risks away from big American banks and toward new lenders outside the banking system,

particularly in the United States and China.

“Markets have grown so large in part

because every time they stumbled, central bankers rescued them with easy money. When markets

rose sharply—as they have in recent years—the authorities stood by, saying they are not

in the business of popping bubbles. Now, the markets are so large it is hard to see how

policymakers can lower the risks they pose without precipitating a sharp decline that is

bound to damage the economy. It’s a familiar problem: Like the big banks in 2008, the global

markets have grown ‘too big to fail.’” —Ruchir Sharma, the Chief Global Strategist of Morgan

Stanley Investments Management (a giant Wall Street firm), “Sowing the Next Downturn”,

New York Times, Sept. 19, 2018, p. A-19.

GLOBAL POSITIONING SYTEM

A satellite-based system which allows anyone on the ground, anywhere in the world, to determine their

exact location within a few meters. The person (or equipment) on the ground receives signals from

multiple satellites and the software in their cell phone (or other device) can calculate their position

from that information and in accordance with the laws of physics (including the speed of light and

even relativistic effects).

“The ideas behind GPS took several decades and many billions of dollars to

develop. No surprise, then, that it was a project of the American military as a way to keep track

of their most important assets around the globe. Only an institution like that could realistically

have afforded or justified building it.

“The technology became available to civilians

in 1983 after a South Korean passenger jet inadvertently strayed into prohibited Soviet airspace

and was shot down, killing all 269 passengers on board. The American government realised that if

positioning technology had been available to the pilot of the airliner, the tragedy might have been

averted.

“Modern military satellites can do much more

than find your location. By bouncing radio waves off the surface of the Earth, some systems can

build up extremely detailed pictures of what is going on there—some are reportedly even capable of

detecting enemy submarines by measuring the tiny disturbances left by their wakes in the curvature

of the ocean surface. And you are probably by now familiar with the high-resolution pictures and

video that satellites record for reconnaissance or to guide missiles.

“Until now, most of these technologies have

remained within armed forces or wrapped up in secretive intelligence agencies. A big part of that

has been down to cost—building a satellite and launching it into space are eye-wateringly

expensive.

“That has been changing in recent years. A new

generation of small satellites that can be built and launched cheaply are bringing to civilians

capabilities that were once the preserve of governments alone.

—The Economist: Simply Science email

report, March 17, 2021.

GLOBAL WARMING

The rise in the average surface temperature of the Earth due to the emission of certain

gases into the atmosphere which cause it to more efficiently trap the radiant energy from

the sun, leading to a result similar to what occurs in a greenhouse. The most important such

gas is carbon dioxide, much of which is now being released into the atmosphere by humans

burning fossil fuels such as coal and petroleum. Carbon dioxide accounts for about two-thirds

of the increasing global warming. About one-third of that warming is caused by the release

of methane, most of which escapes from oil wells.

See also:

CLIMATE CHANGE,

HEAT—Excessive,

SUNLIGHT

“The seven warmest years in the history of accurate worldwide record-keeping

have been the last seven years, and 19 of the 20 warmest years have occurred since 2000.”

—New York Times, “Canadians Wilt as Heat Breaks National Record, with No Letup No Letup

for Days”, June 29, 2021.

“The climate system could jump abruptly from one state to another with

devastating effects.” —Wally Broecker, 1984. [Broecker, who died in 2019, was one of

America’s leading climate scientists and is sometimes referred to as “the grandfather of

climate science.” His early recognition here that there might well be qualitative leaps

in the situation, rather than merely slow gradual change, was especially prescient. —Ed.]

“A new U.N. report warns that global warming is now on track to exceed 3

degrees Celsius (5.4 F) by the end of the century and that only a ‘quantum leap in ambition’

to curb greenhouse gas emissions can avert a planetary climate catastrophe.

“Global emissions rose by 1.3% between

2022 and 2023, reaching a new high of 57.1 gigatons of carbon dioxide equivalent, the report

said. It adds that most nations are not taking steps needed to achieve their long-term

net-zero pledges, meaning the planet will continue to suffer unbridled warming.

“‘We’re teetering on a planetary tight

rope,’ U.N. Secretary-General António Guterres said in a speech on Oct. 24. ‘Either

leaders bridge the emissions gap, or we plunge headlong into climate disaster.’”

—Steve Newman, “Earthweek”, San Francisco Chronicle, Nov. 3, 2024.

GLOBALIZATION [Economics]

‘Globalization’ is a much ballyhooed term in recent decades, but with capitalist roots

that go back for centuries. There are a variety of meanings which the term can have or

include, such as:

• The fairly rapid expansion

of capitalism from its earliest centers of development in a few countries to almost all

other countries and to virtually every corner of the world;

• The tendency toward the

development of a single world market, where commodities from one country can be sold in

other countries and where a more or less uniform world market price develops for

commodities (allowing, however, for differing transportation costs, tariffs added,

etc.);

• Reflecting this, the

great expansion of world trade, and also the growing importance of the export of

capital;

• The international

integration of production of many of the more complicated products, wherein more and

more products include components from many other countries; and

• The formation of

international cartels, transnational corporations (TNCs) or

multinational corporations (MNCs), and a tendency toward

oligopoly even internationally (though much less thoroughly

so than within individual major capitalist countries).

[More to be added... ]

See also sub-topics below, and

LOGISTICS REVOLUTION,

ULTRA-IMPERIALISM

“The need of a constantly expanding market for its products chases

the bourgeoisie over the whole surface of the globe. It must nestle everywhere,

settle everywhere, establish connections everywhere.

“The bourgeoisie has through

its exploitation of the world market given a cosmopolitan character to production

and consumption in every country. To the great chagrin of Reactionists, it has

drawn from under the feet of industry the national ground on which it stood. All

old-established national industries have been destroyed or are daily being

destroyed. They are dislodged by new industries, whose introduction becomes a life

and death question for all civilized nations, by industries that no longer work up

indigenous raw material, but raw material drawn from the remotest zones; industries

whose products are consumed, not only at home, but in every quarter of the globe.

In place of the old wants, satisfied by the production of the country, we find new

wants, requiring for their satisfaction the products of distant lands and climes.

In place of the old local and national seclusion and self-sufficiency, we have

intercourse in every direction, universal inter-dependence of nations. And as in

material, so also in intellectual production. The intellectual creations of

individual nations become common property. National one-sidedness and

narrow-mindedness become more and more impossible, and from the numerous national

and local literatures, there arises a world literature.

“The bourgeoisie, by the

rapid improvement of all instruments of production, by the immensely facilitated

means of communication, draws all, even the most barbarian, nations into civilization.

The cheap prices of its commodities are the heavy artillery with which it batters

down all Chinese walls, with which it forces the barbarians’ intensely obstinate

hatred of foreigners to capitulate. It compels all nations, on pain of extinction,

to adopt the bourgeois mode of production; it compels them to introduce what it

calls civilization into their midst, i.e., to become bourgeois themselves. In one

word, it creates a world after its own image.” —Marx & Engels, Manifesto of the

Communist Party, Ch. I: MECW 6:487-8.

GLOBALIZATION — Exaggeration Of

Although the degree of the globalization of capital in the imperialist era is considerable,

and of considerable importance both economically and politically, there have been

tendencies at various times to overstate or exaggerate its extent and to

forget that the basic situation in modern capitalism is still separate imperialist states

ruled by competing bourgeoisies, and with economies which are still in important ways

largely independent of each other.

The first thing to note is that the

degree of globalization of capitalism varies from one period to another, and not always by

increasing. There have been two main periods of greatly expanding globalization in

the history of capitalist imperialism, and both have occurred towards the end of what were

overall long periods of development leading up to periods of crisis. The first period of

the major expansion of globalization was the couple decades leading up to World War I.

But not only did that war strongly interrupt and to a considerable degree reverse

that strong globalization trend, but perhaps just as much so did the

Great Depression of the 1930s that followed a

decade after World War I. During this period capitalist economies seriously weakened,

tariffs increased, and world trade and other aspects of globalization (such as the export

of capital) actually declined until the end of the Second World War.

After World War II a gradual expansion

of world trade began again, along with the new huge spurt in the export of capital from

the U.S. and later on also from the other major economies (including Britain, Japan and

Germany). But especially from the 1980s on the expansion of all the various aspects of

globalization picked up greater speed and strength. This was the second major period of

expanding globalization.

Although some theorists, especially those

representing the bourgeoisie, began to view this as a “permanent” new feature of world

capitalism, there is already important evidence that a new decline in many aspects of

globalization has been developing. The first serious jolt occurred with the world

financial crisis in 2008-9 and the first decline in world trade in decades. But there are

also other indications (as mentioned in the quotation below), and all this will become a

much more serious weakening of globalization as the world overproduction crisis continues

to develop toward a new intractable depression.

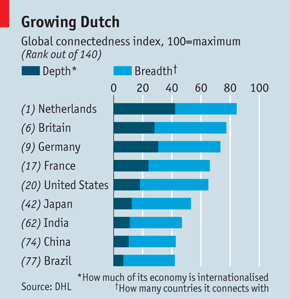

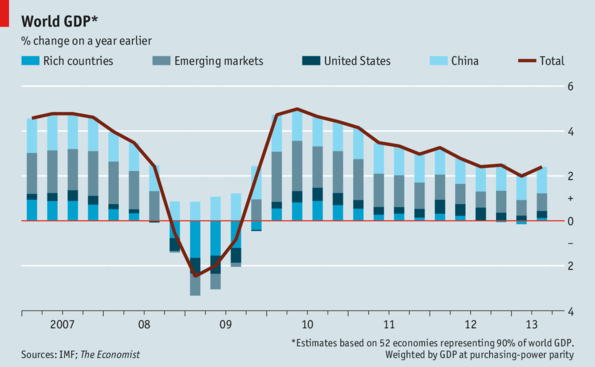

“Globalization Going Backwards: The world is less connected than

it was in 2007.

“How integrated countries are

with the rest of the world varies more than you might expect. And the world is less

integrated in 2012 than it was back in 2007. These are the conclusions of the latest

DHL Global Connectedness Index, which found that the Netherlands is the most

globalized of 140 countries (see chart)....

“The index measures both the

depth of a country’s connectedness (i.e., how much of its economy is internationalized)

and its breadth (how many countries it connects with). The economic crisis of 2008

made connections both shallower and narrower. The depth measure has rebounded since

2009, and is now 10% higher than it was in 2005—though it remains below what it was

in 2007. But the breadth of connectedness has continued to slip, and is now 4% lower

than in 2005.

“At first, as the economic

crisis took hold, both trade and capital flows became less globalized, but since

2009 trade has bounced back whereas capital flows have continued to become less

globalized, says DHL. This seems to reflect a fall in the number of places into

which companies from any given country are willing to put their foreign direct

investment.

“... Mr. [Pankaj] Ghemawat

[of the IESE Business School, who oversees the index] conducts surveys of popular

views of globalization. He finds that people consistently assume that the world is

much more interconnected than it really is.” —The Economist, Dec. 22, 2012,

p. 105.

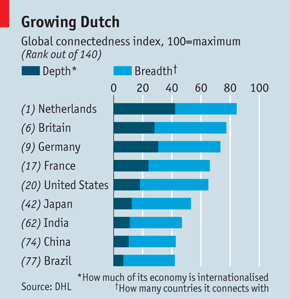

The total Gross Domestic Product (GDP) for all the countries of the world,

for a given year. The Global GDP for 2008 was $61.3 trillion. However, in 2009 the global

GDP dropped for the first time in decades, by 2.4% in real terms, to just $58.2 trillion. It

then expanded again in succeeding years.

The total Gross Domestic Product (GDP) for all the countries of the world,

for a given year. The Global GDP for 2008 was $61.3 trillion. However, in 2009 the global

GDP dropped for the first time in decades, by 2.4% in real terms, to just $58.2 trillion. It

then expanded again in succeeding years.