FICTITIOUS CAPITAL

The value (“capitalized value”) of securities, the ownership of which brings income which

comes ultimately from the surplus value extracted from

the workers during the employment of real (or productive) capital in the

capitalist production process. Thus the market value of stocks, bonds, and all sorts of

derivatives is one major form of fictitious capital. The

word ‘fictitious’ is meant only to show that this is not the same as what is being talked

about with real or operational capital in the actual production process.

Fictitious capital does not have any

intrinsic value and does not perform any function in the current process of capital

reproduction. In a severe financial crisis the value of all the stocks listed on the stock

markets may fall in half, which might represent a loss of many trillions of dollars to the

owners of these stocks. But this is a destruction of fictitious capital, and not the

destruction of real factories, machinery and other productive wealth. Over time the

amount of fictitious capital grows much faster than the amount of real productive capital.

This is part of what is meant by the financialization

of modern capitalism.

“The formation of fictitious capital is known as capitalization.

Any regular periodic income can be capitalized by reckoning it up, on the basis of

the average rate of interest, as the sum that a capital lent out at this interest

rate would yield. For example, if the annual income in question is £100 and

the rate of interest 5 per cent, then £100 is the annual interest on

£2,000, and this £2,000 is then taken as the capital value of the legal

ownership title to this annual £100. For the person who buys this ownership

title, the annual £100 does actually represent the conversion of the capital

he has invested into interest.” —Marx, Capital, vol. III, ch. 29. (Penguin

ed., p. 597; International ed., p. 466.)

FINAL CAUSE

[In Aristotle’s philosophy:] The purpose, end, aim, or goal

of something.

Aristotle defined 4 different kinds of

“causes” which he thought most things must have. The first,

the “material cause”, was the mere material composition of the thing, and the second, the

“formal cause”, was just the form or shape that this material had to take on. (Weird

things to call causes!) The third of these, the efficient cause, is the one that

sounds most like what we normally mean by the “cause of something” today, namely how the

thing is created or comes to be. But what Aristotle called the fourth type of cause, the

final cause (or, in Greek, telos), is the aim or purpose of the thing. Thus

the efficient cause of a table is the work of someone creating the table out of

wood or other raw materials. And the final cause is the purpose of the labor (e.g.,

to create the table to put other objects on).

To most of us today there seems to be no

real point in calling the purpose of something its “final cause”; why not just call it

its purpose and be done with it?! But by calling this a different sort of “cause”,

Aristotle was helping to convince himself that a purpose is something which most

natural things must have. However, in reality, some things have a purpose, and other things

are not the result of anyone’s purpose or goal. The chemical composition of the water

molecule or the shape of the Andes mountain range are natural things, and were not the

result of anyone’s goal or purpose. And even Aristotle did recognize the possibility of

chaos, that some things arise from chance events and thus have no final cause.)

The notion of a “final cause” is therefore

a teleological concept, and should really only exist where

there was some genuine purpose or goal involved in the creation of the thing. But according

to idealists like Aristotle, there is some “final cause” to

all sorts of things that in reality merely evolved or otherwise naturally developed. Thus,

according to him, the final cause of the existence of animals and plants (since he could

think of no other) must be to serve the needs and purposes of human beings. Aristotle

himself argued that a final cause can exist even when there is no intelligence or

consciousness behind it. But why should animals and plants have come to exist for the

benefit of human beings if there was no purposeful intelligence guiding the process—in

other words a God? Religious people of course find such erroneous conclusions to their

liking, and this is one of the important reasons that Thomas

Aquinas and other theologians have enthusiastically embraced at least aspects of

Aristotle’s thought.

See also:

PURPOSE,

TELEOLOGY

“FINAL SOLUTION, The”

The euphemism that Nazi Germany used for the planned total genocide of the Jews, which they

actually carried out to a horrifying degree. The standard estimate for the number of Jews

murdered by the Nazis in their gas chambers and other ways is six million.

However, it is often forgotten today that

German imperialism had essentially the same program for Romani (“Gypsies”), Communists,

homosexuals, the disabled, and—most wildly murderous of all—the greater part of all the

tens of millions of Slavic peoples to the East. Moreover, Hitler

was inspired in these plans by what European colonists had done to native peoples in North

America.

See also:

HIMMLER, Heinrich

“This is a review article of a new economic history of the Nazi economy

by Adam Tooze which cuts through the debate between economics and Hitler’s mistakes as

fundamental causes of the outcome [of World War II]. Instead, Tooze argues that the

invasion of the Soviet Union was the inevitable result of Hitler’s paranoia about the

land-starved backwardness of German agriculture as contrasted with the raw material and

land resources of America’s continent and Britain’s empire. The American frontier

expansion that obliterated the native Indians provided Hitler with an explicit precedent,

which he often cited, for pushing aside the native populations in the east to provide

land for German Aryan farmers.

“Germany’s agricultural weakness

is summarized by its low land-labor ratio, but Poland and the Ukraine had even less

land per person. Thus simply acquiring the land to the east could not solve Germany’s

problem of low agricultural productivity without removing the native farming populations.

Far better than other histories of the Third Reich, Tooze reveals the shocking details

of General Plan Ost, the uber-holocaust which would have removed, largely through murder,

as many as 45 million people from eastern agricultural land. Tooze, like the Nazis before

him, fails to emphasize that the solution to Germany’s agricultural problem was not

acquiring more land for the existing German farm population, but rather by raising the

land-labor ratio by making the existing German land more efficient, mechanizing

agriculture and encouraging rural-to-urban migration within Germany.” —Robert J. Gordon,

from the abstract of “Did Economics Cause World War II?”, a review article, NBER Working

Paper No. 14560, December 2008. [This brings out the horrific genocidal imperialist

nature of the Nazi quest for Lebensraum. Perhaps the best student of the genocide

against Native Americans by white capitalist America was none other than Adolf Hitler!

—S.H.]

“In 1865, the Gold Hill News of Nevada put the matter bluntly,

urging ‘a final solution of the great Indian problem: by exterminating the whole race,

or driving them forever beyond our frontier.’” —Scott Lankford, Tahoe Beneath the

Surface (2010), p. 71.

FINANCE CAPITAL (Book by Hilferding)

An important book by Rudolf Hilferding, a

semi-Marxist economist, published in 1910, which strongly influenced Marxist thought

about the nature of capitalism in the imperialist era. In particular, Lenin made

extensive use of the ideas in this book when he wrote his own very important work,

Imperialism, the Highest Stage in Capitalism in 1916.

The full title of the original German

edition of the book is Das Finanzkapital: Eine Studie über die jüngste

Entwicklung des Kapitalismus, which was published in Vienna in 1910. An English

translation did not appear until more than 70 years later: Finance Capital: A Study

of the Latest Phase of Capitalist Development, edited by Tom Bottomore, (London:

Routledge & Kegan Paul, 1981).

Finance Capital put forward a

number of ideas, many of them new and correct, but also some quite incorrect ideas and

conceptions. Hilferding pointed out that banks had shifted their credit practices as

industrial companies became larger, in the direction of much bigger and more long-term

loans, which in turn gave them a deeper interest in the long-term prospects and

management of the industrial corporations they loaned to, instead of just a simple

concern as to whether a short-term loan would be repaid or not. Banks became more like

silent partners in the industrial corporations, and thus also tended to receive a

greater share of the surplus value which the corporations extracted from their workers.

He said that the typical capitalist was no longer the owner/manager of a company, but

rather a shareholder in a corporation, and explained this change as being a necessary

consequence of the growth of giant companies into monopolies or semi-monopolies. And

these shareholders, he said, have become in effect money capitalists, not

entrepreneurs.

The book shows how the competitive and

pluralistic pre-monopoly form of “liberal capitalism” had been transformed into monopoly

capitalism controlled by “finance capital”, a merger of bank and industrial capital.

But Hilferding tends to generalize too much on the precise way that had occurred in

Germany. He puts too much emphasis on the role of cartels and trusts, and doesn’t foresee

that these might be broken up to a considerable degree through a combination of

international conflict (such as came to a head just a few years later in World War I)

and anti-trust laws (even if they have had only a

partial and fairly weak effect). Hilferding did foresee the more total domination

and centralized direction of the state by this new form of capitalism, however.

One of the more serious weaknesses in

Finance Capital, and one that has been far too influential, is the falling

rate of profits theory of capitalist economic crises that Hilferding presents. This

comes, of course, originally from Capital, where it was one of three major crisis

theories put forward by Marx. But this particular theory is incorrect, and Hilferding’s

championing of it has done a lot of additional harm in Marxist political economy. For

one thing, it led him to modify his theory of finance capitalism a few years later by

putting forth the totally erroneous notion that an “organized capitalism” is possible,

based on national and international cartels and monopoly stabilization of profits, which

could supposedly prevent the development of economic crises entirely! Hilferding also

thought that turning capitalism into socialism had become primarily a matter of just

nationalizing the big trusts and cartels. This showed the essential bourgeois core of

his understanding of just what socialism is all about.

“In 1910, there appeared in Vienna the work of the Austrian Marxist,

Rudolf Hilferding, Finance Capital (Russian edition, Moscow, 1912). In spite

of the mistake the author makes on the theory of money, and in spite of a certain

inclination on his part to reconcile Marxism with opportunism, this work gives a

very valuable theoretical analysis of ‘the latest phase of capitalist development’,

as the subtitle runs.” —Lenin, Imperialism, the Highest Stage of Capitalism

(January-June 1916), LCW 22:195.

“Finance Capital has proved to be the most influential text

in the entire history of Marxian political economy, only excepting Capital

itself. It is difficult to think of any significant theme in Lenin’s theory of

imperialism, for example, that does not feature, usually prominently, in Finance

Capital. There is the central concept of finance capital, seen as the ‘highest

stage’ of capitalist development; the growth of monopoly in place of free competition;

the repudiation of free trade by the capitalists and their increasing reliance on

tariffs to bolster their cartels; the emphasis on capital exports and colonization,

together with the mounting international tension that they generate; and finally the

apocalyptic tone of Hilferding’s conclusion. All these can be found, in simpler

language and considerably less depth, in Lenin’s Imperialism.” —M.C. Howard

& J.E. King, A History of Marxian Economics: Volume I, 1883-1929 (Princeton

University Press, 1989), p. 100.

[It is probably true that

Hilferding’s book has been the most influential single book on Marxist political

economy other than Capital itself. But this has also had plenty of quite bad

results, as well as some good ones! For example, it certainly would have been much

better if Marx’s Theories of Surplus Value had been more influential than

Finance Capital in the areas where they disagree (such as on the central cause

for capitalist economic crises)! And while it is true that most of the major themes

in Lenin’s Imperialism, the Highest Stage of Capitalism were prefigured in

Hobson’s Imperialism and Hilferding’s Finance Capital, Lenin never

claimed otherwise. In fact he properly credits both authors and both books. (It is

interesting that Hilferding does not credit Hobson, who came before him!)

Moreover, Lenin subtitles his pamphlet as “A Popular Introduction”, so it is hardly

surprising that it does not go into the issues as thoroughly as Hilferding does in

his much longer book. Moreover, besides the good and correct things in it, Hilferding’s

book also puts forward a number of wrong ideas, a number of which Lenin

strongly criticizes. Finally, in the years after Finance Capital was published,

Hilferding retracts and abandons some of his correct ideas in it, and instead promotes

some very wrong notions in their place, such as his theory of “organized capitalism”

which can supposedly avoid economic crises, which he began putting forward in 1915.

—S.H.]

“Thus Finance Capital changed the landscape of Marxian

economics.... Hilferding provided not only new concepts, new analyses, and a new

vocabulary, but an attempted synthesis. Nevertheless the defects of the book are

readily apparent. He achieved neither a single coherent account of economic crises

nor a clear explanation of their relationship with the longer-term contradictions

of advanced capitalism. He had neither a theory of economic breakdown nor a

refutation; although the germ of his subsequent concept of a largely crisis-free

‘organized capitalism’ can be found in Finance Capital ... the book contains

no unequivocal prognoses. Hilferding’s treatment of capital exports is also

imprecise.” —M.C. Howard & J.E. King, ibid.

FINANCE CAPITALISM

The form of capitalism in the imperialist era characterized by the overwhelming dominance

in the economy of giant banks and financial institutions, and the

financialization of the economy in general. The term

finance capitalism is used, rather than capitalist-imperialism or

monopoly capitalism, when it is desired to emphasize

the financial aspects of monopoly capitalism.

There have been two main bursts in the

expansion of finance capitalism (and globalization):

1) the period in the late 1800s up

until World War I; and

2) the period from roughly the 1980s

up until the financial crisis broke out in 2008.

The first of these bursts of financialization

corresponded to, and was an important part of, the advent of capitalist-imperialism.

After World War I finance capitalism further developed a bit in fits and starts during the

1920s, but then suffered a major breakdown in the Great

Depression of the 1930s. With the tremendous destruction of capital during World War II,

the stage was set for a new quarter-century capitalist boom that initially did not require

any further qualitative exaggeration of financialization in the world capitalist economy.

(This period was, however, still part of the capitalist-imperialist epoch dominated by

finance capital.) But as the post-World War II

boom petered out in the 1970s, the world capitalist-imperialist system began to rely more

and more on a combination of neoliberalism and a renewed

burst of qualitative expansion of the financial aspects of the economy. This meant the huge

further growth of debt, and rampant speculation in that debt, that finally began to collapse

in a major way in 2007-2008.

Until capitalism is overthrown worldwide,

its specific form as finance capitalism will continue to exist, even during periods

of severe crisis and depression.

“Translated into ordinary human language this means that the

development of capitalism has arrived at a stage when, although commodity production

still ‘reigns’ and continues to be regarded as the basis of economic life, it has in

reality been undermined and the bulk of the profits go to the ‘geniuses’ of financial

manipulation. At the basis of these manipulations and swindles lies socialized

production; but the immense progress of mankind, which achieved this socialization,

goes to benefit ... the speculators.” —Lenin, “Imperialism, the Highest Stage of

Capitalism” (1916), LCW 22:206-7.

FINANCIAL RISKS [Wall Street]

“I also answered the hotline and would sometimes find myself

answering questions from clients at big banks. Eager to repair their tattered image

[after the Wall Street meltdown in 2008], they wanted to be viewed as responsible,

which is why they were calling in the first place. But, unlike the hedge funds, they

showed little interest in our analysis. The risk in their portfolios was something

they almost seemed to ignore. Throughout my time at the hotline, I got the sense that

the people warning about risk were viewed as party poopers or, worse, a threat to

the bank’s bottom line. This was true even after the cataclysmic crash of 2008, and

it’s not hard to understand why. If they survived that one—because they were too big

to fail—why were they going to fret over risk in their portfolio now?

“The refusal to acknowledge risk

runs deep in finance. The culture of Wall Street is defined by its traders, and risk

is something they actively seek to underestimate. This is a result of the way we

define a trader’s prowess, namely by his ‘Sharpe ratio,’ which is calculated as the

profits he generates divided by the risks in his portfolio. This ratio is crucial to

a trader’s career, his annual bonus, his very sense of being.” —Cathy O’Neil,

Weapons of Math Destruction (2017), pp. 45-46.

FINANCIAL SECTOR OF THE ECONOMY

![The changing makeup of the U.S. financial sector. [From: K. Phillips, ‘Bad Money’, 2008.]](Photos/F/FinancialSphere-US.jpg) The portion of an economy which consists of banking, credit cards, auto loans, insurance,

the management of pension funds, stock brokerages, and so forth. The issuance of mortgages,

and other forms of real estate speculation such as Real Estate Investment Trusts (REITs),

etc., is also a major and ever larger part of the financial sector, though the actual

construction of buildings is in a separate category. Sometimes the term “FIRE” is used for

the overall financial sector of the economy; it is short for “Finance, Insurance, and Real

Estate”.

The portion of an economy which consists of banking, credit cards, auto loans, insurance,

the management of pension funds, stock brokerages, and so forth. The issuance of mortgages,

and other forms of real estate speculation such as Real Estate Investment Trusts (REITs),

etc., is also a major and ever larger part of the financial sector, though the actual

construction of buildings is in a separate category. Sometimes the term “FIRE” is used for

the overall financial sector of the economy; it is short for “Finance, Insurance, and Real

Estate”.

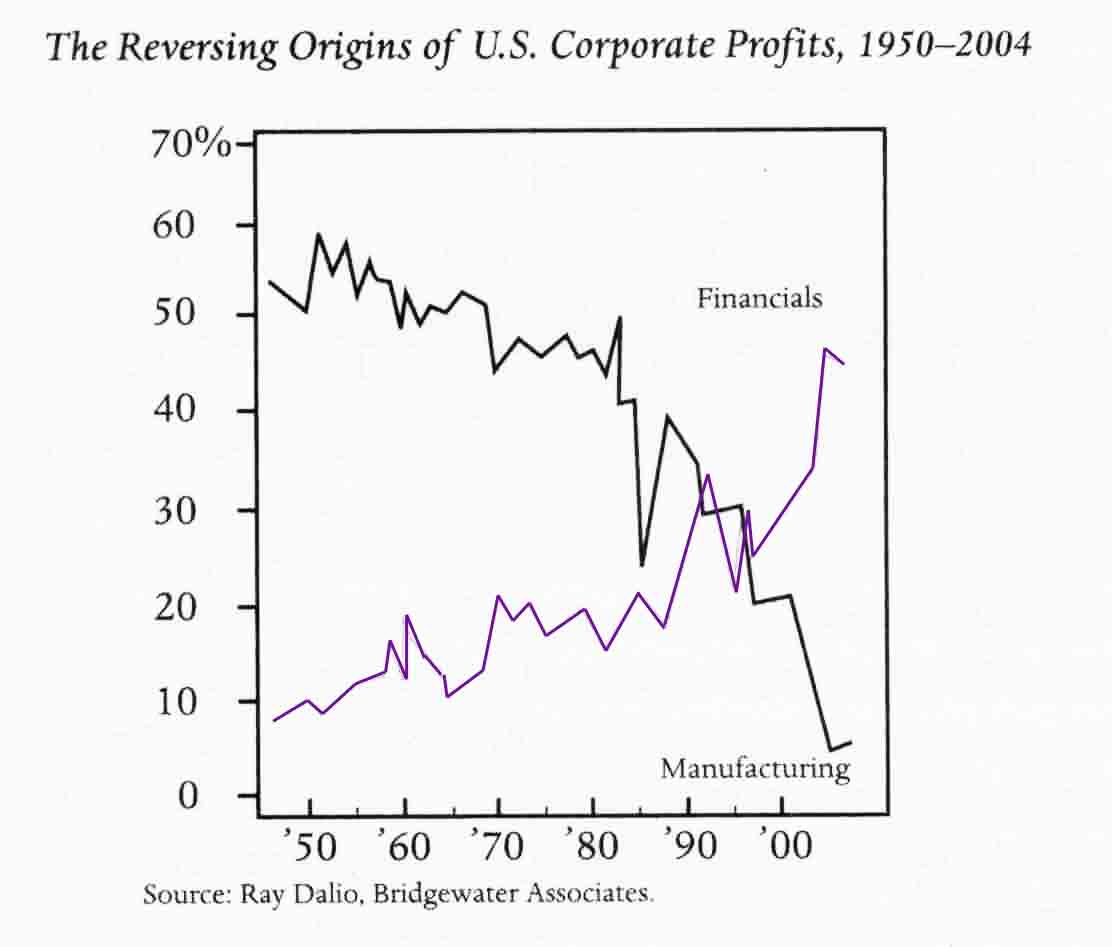

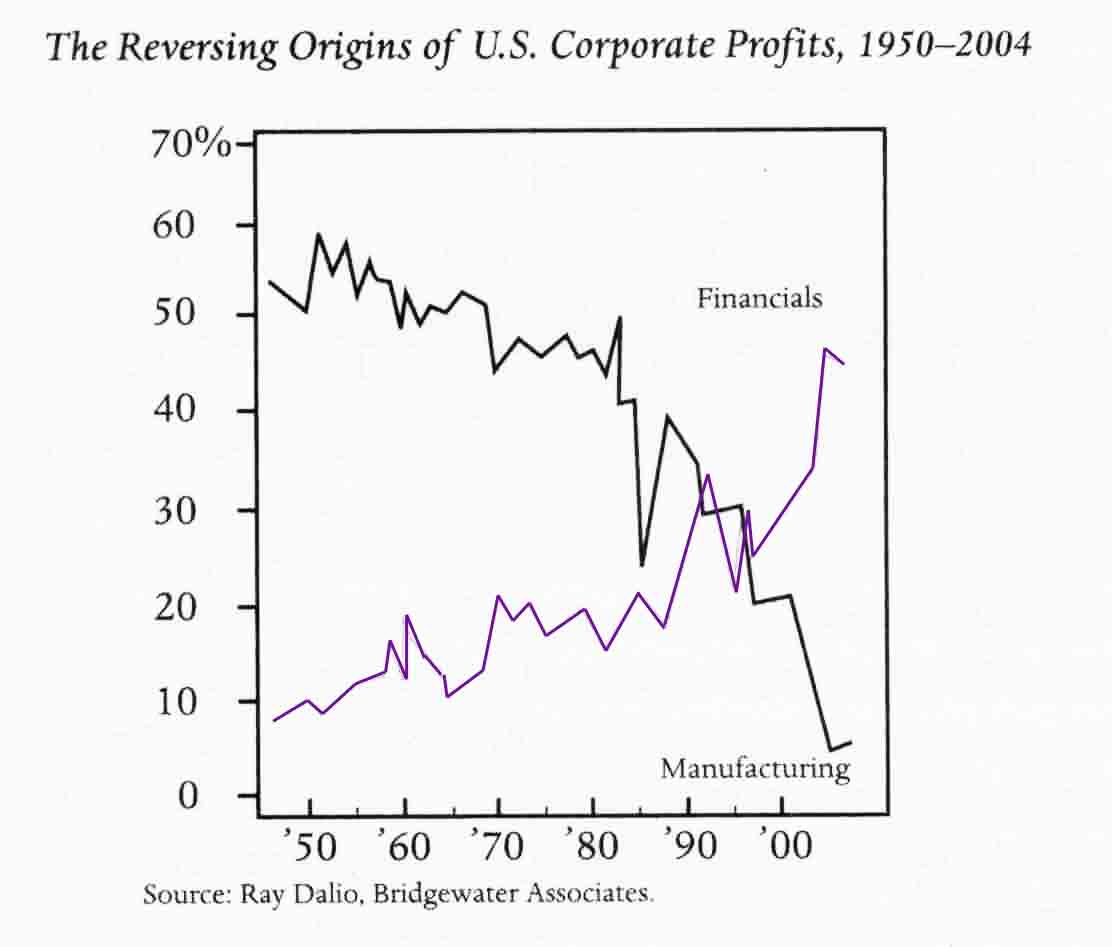

Over time in the development of capitalism,

especially in the modern capitalist-imperialist

era, this sector has been expanding rapidly, while manufacturing and other sectors decline

relatively. This is part of what is meant by the financialization of the economy (see below),

and shows how capitalism has continued to grow ever more parasitic.

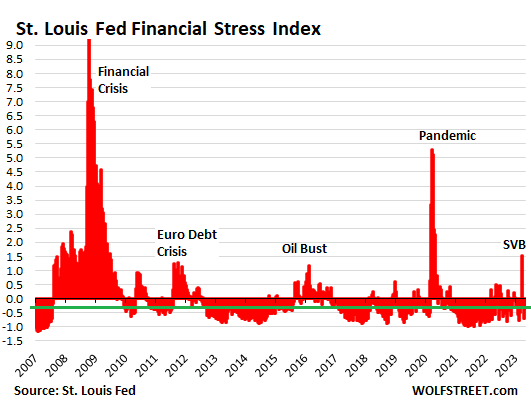

It is true, however, that in times of crisis

(such as the present) the overall trend for the financial sector to relatively increase as a

proportion of the whole economy, and also in its share of total profits, can be reversed.

According to one recent bourgeois definition of the U.S. financial sector (which actually

somewhat understates its extent) a record high percentage of all profits (41.7%) which came

to that sector occurred in the one-year period ending on Sept. 30, 2002. This had fallen to

29.3% of all corporate profits by the one-year period ending on March 31, 2011. [“The

Incredible Shrinking Financial Sector”, Business Week, June 13-19, 2011, p. 45.]

The chart at the right shows how the makeup

of the U.S. financial sector itself has changed in recent decades. ‘GSE’ stands for

“Government-Sponsored Enterprise” (i.e., a quasi-government

corporation, such as Fanny Mae). Note how GSEs have become more and

more important within the financial sphere as housing bubbles have been built up to enormous

levels. The government itself is becoming an ever larger component of the financial sector

of the U.S. economy, without even considering its massive bailouts and supports for the

giant banks and other “private” financial institutions.

FINANCIAL TECHNOLOGY

The use of technology, especially computer and communications technology, to promote the further

financialization of a capitalist-imperialist economy, and the merging of such technology and

financial activity into a unified sphere in the overall economy. This has gotten to be so

extensive, and so central to modern capitalism in the recent decades of the imperialist era that

it has now acquired its own short-hand name in capitalist circles: the “Fintech sector”.

One recent new scheme in financial technology is

to use “blockchains” (encrypted databases distributed throughout a network, functioning as

financial ledgers) to try to guarantee the security of financial transactions over the Internet.

(At present it is not really known just how successful or permanently “secure” these blockchain

financial databases will turn out to be.)

“In addition to combining traditional financial services with technological

solutions, Fintech also unites e-commerce [marketing via the Internet], infrastructure

service providers and telecommunications companies under one roof.” —“Singapore:

Digitization of a Financial Powerhouse”, ASEAN Briefing, April 8, 2019.

FINANCIALIZATION (Of the Economy)

The qualitative growth of the FINANCIAL SECTOR (see above) of a

capitalist economy, which has been a major feature of capitalism in the

capitalist-imperialist (or monopoly capitalist)

era. Over time the financial sector becomes an ever larger part of the overall economy (in

terms of GDP, employment, etc.), and becomes an ever larger source of profit (which it

extracts in a totally parasitic manner from the rest of the economy). (This overall trend,

however, can be reversed in times of acute crisis.) Moreover, a major feature of this

financialization, is the ever closer de facto merger of financial capital with the

state—the agencies of the government (such as, in the U.S., the Treasury Department, the

Federal Reserve System, numerous other federal agencies, the large number of gigantic

GSEs, and so forth.) This aspect of the overall trend is actually

accentuated in times of acute crisis.

The qualitative growth of the FINANCIAL SECTOR (see above) of a

capitalist economy, which has been a major feature of capitalism in the

capitalist-imperialist (or monopoly capitalist)

era. Over time the financial sector becomes an ever larger part of the overall economy (in

terms of GDP, employment, etc.), and becomes an ever larger source of profit (which it

extracts in a totally parasitic manner from the rest of the economy). (This overall trend,

however, can be reversed in times of acute crisis.) Moreover, a major feature of this

financialization, is the ever closer de facto merger of financial capital with the

state—the agencies of the government (such as, in the U.S., the Treasury Department, the

Federal Reserve System, numerous other federal agencies, the large number of gigantic

GSEs, and so forth.) This aspect of the overall trend is actually

accentuated in times of acute crisis.

See also entries above, and:

FINANCE CAPITALISM,

FICTITIOUS CAPITAL,

GLOBAL FINANCIAL ASSETS,

GLOBAL FINANCIAL MARKETS,

HEDGE FUND,

PAYBACK TIME

“Over the past generation—ever since the banking deregulation of

the Reagan years—the U.S. economy has been ‘financialized.’ The business of moving

money around, of slicing, dicing and repackaging financial claims, has soared in

importance compared with the actual production of useful stuff. The sector officially

labeled ‘securities, commodity contracts and investments’ has grown especially fast,

from only 0.3 percent of G.D.P. in the late 1970s to 1.7 percent of G.D.P. in 2007.”

—Paul Krugman, a liberal bourgeois economist, “The Joy of Sachs”, The New

York Times, July 17, 2009. [Krugman fails to note: 1) that the securities sector

he mentions is only one small part of the entire financial sector; and 2) that this

financialization of the economy has all along been a prominent feature of

capitalism in the imperialist era, as Lenin noted as far back as 1916! But it is

true that this financialization has been carried to even more absurd lengths during

the last few decades. —S.H.]

“The money that’s made from manufacturing stuff is a pittance in

comparison to the amount of money made from shuffling money around. Forty-four

percent of all corporate profits in the U.S. come from the financial sector compared

with only 10% from the manufacturing sector.” —Raymond Dalio, Bridgewater Associates,

2004. [Quoted in Kevin Phillips, Bad Money: Reckless Finance, Failed Politics, and

the Global Crisis of American Capitalism (2008).

“‘The business of corporate America is no longer business—it is

finance,’ said Rana Foroohar [of Time magazine]. Companies are increasingly

focused on profiting not by investing in improvements to their products and services,

but simply by moving money around. Apple, which has $200 billion in cash, has borrowed

billions of dollars in recent years to buy back its own shares in order to boost the

company’s stock price. ‘Why borrow?’ Because it’s cheaper than repatriating profits

and paying U.S. taxes. And Apple isn’t alone ‘in eschewing real engineering for the

financial kind.’ Airlines now make more money hedging oil prices than selling seats,

even though the strategy increases global commodities volatility. Pharmaceutical

companies—which have cut nearly 150,000 jobs since 2008, mostly in research and

development—are now so focused on ‘creative accounting’ and tax optimizations that

they ‘look suspiciously’ like portfolio management companies. ‘Even Silicon Valley is

not immune,’ with tech behemoths anchoring huge new bond offerings just as investment

banks do. ‘None of this is good for the real economy.’ A wealth of research shows

financial engineering impedes growth and ‘destroys long-term value within companies.’

Corporate America’s addiction to financialization is a recipe for ‘more economic

stagnation—and more political populism.’” —“Moving Money to Make Money”, The

Week [bourgeois news magazine], May 27, 2016, p. 34.

“Part of the challenge in recruiting American workers for factory

jobs is overcoming stereotypes of manufacturing as a relic of the past. For decades,

U.S. business and political leaders have pushed finance over factories.”

—New York Times, “Facts of Interest”, December 9, 2025.

FIRE DEPARTMENTS — PRIVATE!

Private companies which will fight fires and protect the property of the rich. These are

becoming much more common because of the seriously worsening wildfire dangers due to global

warming. And, in general, because the capabilities of all public social services—including

fire departments—are simply not keeping up with rapidly increasing environmental and social

dangers. The basic reasons for this are the growing governmental financial and economic

problems in crisis-ridden late capitalist society. In addition, the rich tend to have

estates in rural or semi-rural wooded areas where rapidly-spreading wildfires can suddenly

and quickly approach their mansions. Instead of allowing big tax increases on themselves

to greatly expand government fire departments, many of the most wealthy are now hiring the

services of these new private fire departments. So the public be damned, and each millionaire

or billionaire for himself!

“A two-person private firefighting crew with a small vehicle can cost

$3,000 a day, while a larger crew of 20 firefighters in four fire trucks can run to

$10,000 a day, according to a private firefighting company in Oregon.”

—New York Times, “Some with Wealth Rely on Private Firefighters”, January 14,

2025.

FISA COURTS

Secret U.S. government courts, created by the Foreign Intelligence Surveillance Act of 1978,

which virtually automatically grant the NSA, FBI,

CIA and other U.S. spy agencies the legal right to proceed with what

would otherwise be outrageously illegal wire tapping and spying on Americans. These courts

function as a totally hypocritical pretense that this spying is “justified” and that proper

judicial review is regulating it—when in fact in practice the government essentially has a

completely free hand to spy on everyone.

“With expanded powers under congressional legislation in 2007 and

2008 that legalized [President George W.] Bush’s once illegal program, the NSA launched

PRISM, a program that compelled nine Internet service providers to transfer what became

billions of emails to its massive data farms. And the FISA courts, originally created

to check the national security state, instead became its close collaborator, approving

nearly 100 percent of government wiretap requests and renewing the NSA’s mass metadata

collection of all US phone calls thirty-six consecutive times from 2007 to 2014.”

—Alfred W. McCoy, In the Shadows of the American Century: The Rise and Decline of

US Global Power (2017), p. 122.

“FIVE-POINT PRINCIPLE OF PUTTING POLITICS IN COMMAND”

A set of guidelines for how to go about putting “politics

in command” which was instituted within the People’s Liberation Army in China during

the early GPCR period (when Lin Biao was in command):

“The five-point principle of putting politics in command is:

a) creatively study and apply Chairman Mao’s works and, in particular, make the utmost

effort to apply them; regard Chairman Mao’s works as the highest instructions on all

aspects of the work of the army; b) persist in the ‘four-firsts’

and, in particular, make great efforts to grasp living ideas; c) leading cadres must go

to the basic units, give energetic leadership to the campaign to produce

‘four-good’ companies, guarantee that the basic units

do their jobs effectively and at the same time that a good style of leadership by the

cadres is fostered; d) boldly promote really outstanding commanders and fighters to key

posts of responsibility; and e) train hard and master the finest techniques and

close-range and night fighting tactics.” —From a short glossary accompanying an article

in Peking Review, vol. 10, #3, Jan. 13, 1967, p. 10.

FIVE REQUIREMENTS FOR SUCCESSORS TO THE REVOLUTIONARY CAUSE OF THE PROLETARIAT

This was a term developed in Maoist China, and strongly emphasized during the years of the

Great Proletarian Cultural Revolution. It referred to the following

points which must be true of revolutionary successors:

“They must be genuine Marxist-Leninists and not revisionists like

Khrushchev wearing the cloak of Marxism-Leninism.

“They must be revolutionaries who

wholeheartedly serve the overwhelming majority of the people of China and the whole

world, and must not be like Khrushchev who serves both the interests of the handful of

members of the privileged bourgeois stratum in his own country and those of foreign

imperialism and reaction.

“They must be proletarian statesmen

capable of uniting and working together with the overwhelming majority. Not only must

they unite with those who agree with them, they must also be good at uniting with those

who disagree and even with those who formerly opposed them and have since been proved

wrong in practice. But they must especially watch out for careerists and conspirators

like Khrushchev and prevent such bad elements from usurping the leadership of the Party

and the state at any level.

“They must be models in applying

the Party’s democratic centralism, must master the method of leadership based on the

principle of ‘from the masses, to the masses,’ and must

cultivate a democratic style and be good at listening to the masses. They must not be

despotic like Khrushchev and violate the Party’s democratic centralism, make surprise

attacks on comrades or act arbitrarily and dictatorially.

“They must be modest and prudent

and guard against arrogance and impetuosity; they must be imbued with the spirit of

self-criticism and have the courage to correct mistakes and shortcomings in their work.

They must never cover up their errors like Khrushchev, and claim all the credit for

themselves and shift all the blame on others.” —From a short glossary in Peking

Review, vol. 10, #3, January 13, 1967, p. 10.

![The changing makeup of the U.S. financial sector. [From: K. Phillips, ‘Bad Money’, 2008.]](Photos/F/FinancialSphere-US.jpg) The portion of an economy which consists of banking, credit cards, auto loans, insurance,

the management of pension funds, stock brokerages, and so forth. The issuance of mortgages,

and other forms of real estate speculation such as Real Estate Investment Trusts (REITs),

etc., is also a major and ever larger part of the financial sector, though the actual

construction of buildings is in a separate category. Sometimes the term “FIRE” is used for

the overall financial sector of the economy; it is short for “Finance, Insurance, and Real

Estate”.

The portion of an economy which consists of banking, credit cards, auto loans, insurance,

the management of pension funds, stock brokerages, and so forth. The issuance of mortgages,

and other forms of real estate speculation such as Real Estate Investment Trusts (REITs),

etc., is also a major and ever larger part of the financial sector, though the actual

construction of buildings is in a separate category. Sometimes the term “FIRE” is used for

the overall financial sector of the economy; it is short for “Finance, Insurance, and Real

Estate”.

The qualitative growth of the FINANCIAL SECTOR (see above) of a

capitalist economy, which has been a major feature of capitalism in the

The qualitative growth of the FINANCIAL SECTOR (see above) of a

capitalist economy, which has been a major feature of capitalism in the