INVENTION

The invention of new machines and new production techniques is something which is furthered

by the sociopolitical advancement of society. Invention was much fostered with the advent of

capitalism, was additionally fostered with the advent of capitalist-imperialism, and will be

fostered to an even greater degree under socialism and communism when workers and technicians

come to understand that their new ideas benefit both themselves and the people in general,

and not just a handful of capitalists!

“Competition becomes transformed into monopoly. The result is immense

progress in the socialization of production. In particular, the process of technical

invention and improvement becomes socialized.

“This is something quite different

from the old free competition between manufacturers, scattered and out of touch with

one another, and producing for an unknown market.” —Lenin, “Imperialism, the Highest

Stage of Capitalism”, LCW 22:205.

INVERSION [In contemporary corporate finance]

A method of avoiding taxes on corporate profits by buying up another company in a lower-tax

country, moving the headquarters of the combined company to that other country, and thus

“officially” becoming a foreign corporation. U.S. corporations with huge foreign profits

presently do not need to pay U.S. taxes on those profits until they “repatriate” the money

(i.e., send it back to the corporate headquarters in the U.S.). Inversion allows them to

avoid those and other taxes permanently.

As of late September 2014, at least 75 major

corporations (including the fast food giant, Burger King) have already pulled this inversion

scam and cheated the U.S. government out of billions of dollars in corporate taxes. Congress

has recently been debating whether to change the law to make this sort of tax cheating more

difficult, though many in Congress (who more directly represent these cheating corportions)

favor just lowering corporate taxes even further so that companies have no need to pull

this scam in the first place. (The U.S. corporate tax rate has already been lowered to an

official 35%; however, the plethora of tax loopholes means that most corporations pay a

much lower rate, many of them less than 10% and each year many corportions already pay no

taxes whatsoever.)

See also:

CORPORATE TAXES,

TAX LOOPHOLES

“INVERTED SPECTRUM”

This is a puzzle or sort of a thought experiment championed by those influenced by

philosophical idealism (as most of us have been to some degree in

this society!). It is often presented along these lines:

How do I know that others see what I call red when they look at

something that is red? Sure, they also call it red, but how do I know it

looks the same to them as red looks to me? Couldn’t they be having the

same subjective experience as I have when I look at blue things, for example? And

couldn’t they have the subjective experience of seeing “redness” when they look

at what we both call blue things?

In Chapter 23 of his book I Am A Strange Loop (NY: Basic Books, 2007), pages 333-338,

Douglas Hofstadter discusses this riddle at length and utterly demolishes it. (If this riddle

really bothers you, I suggest you go there for the full antidote! I’ll just refer to a few of

his points here.)

Hofstadter notes that those who are impressed by

this inverted spectrum argument make the unacknowledged assumption that “our experiences

of redness and blueness are totally disconnected from physics”. The feeling of a color,

they think, is some sort of individual invention which two different people could “invent” in

two entirely different ways. Actually, if two different people have senses which are more or

less equally capable of discriminating light of a certain color, and whose brains have neural

networks which signal when this specific color of light is detected, then there is every

reason to believe that the subjective experience of the two people is also equivalent. Why

would evolution have developed two wildly diverse subjective neural networks on top of

what is necessary to recognize and register the presence of a given color in an object? Moreover,

if the two people had developed these additional unnecessary subjective neural networks

(to reflect this differing subjective “redness” or “blueness”), this would be discoverable by

the close inspection of the two different brains. No such differences in brains have been

discovered, and no neurophysiologists really believe that they ever will be.

Hofstadter goes on to note that any presumed

difference in subjective feeling associated with the same color would therefore have to

be entirely unrelated to any physical structure of the brain or its neural networks. In other

words, the differences would have to be entirely in the realm of mind as opposed

to physical brains. Thus, this notion of the possibility of “inverted spectrums” (and of

generalizations of the idea encompassed under the name of “qualia”)

must of necessity imply a dualistic theory of mind and brain (matter). And

dualism, from the materialist perspective, and since it denies

that matter is the necessary basis for all mental phenomena, is merely a variety of philosophical

idealism.

INVESTIGATION — Before Launching Political Action

We must carefully investigate the objective situation before attempting to lead the masses in

political action, whether that action is in a small and local struggle or a major attempt at

insurrection. This investigation should cover all aspects of the actual situation: the strength of

the enemy, and the strength of the people’s forces; the mood of the people and their level of

determination; the status of intermediate forces and the possibilities for winning them over to

the side of the people; and even the real preparations and readiness of the Party and of the

advanced forces themselves.

“Give me an exact count of your strength. Name the units which will

definitely follow us. Which ones are wavering? Who is against us? Where are the storehouses

of rifles and other military supplies? What can the enemy rely on in the areas neighboring

Petrograd? Where are the food supplies concentrated and are there sufficient quantities?

Has the security of the Neva bridges been provided for? Has the rear been prepared for

retreat in the event of failure?” —Lenin, speaking to the Bolshevik Central Committee during

the heady “July Days” of 1917, when a spontaneous revolutionary upsurge among the masses

seemed to lead many Bolshevik leaders to forget the need for careful investigations and

preparations before attempting to lead the masses in insurrection. [This brief recounting

of Lenin’s comments at this meeting is by K. Mekhonoshin who represented the Bolshevik

Military Organization there, and is reprinted in Ronald W. Clark, Lenin: A Biolography,

(NY: Harper & Row/Perennial, 1988), p. 237. Lenin’s comments on this occasion seem to have

led the Central Committee to reconsider, avoid immediate rash action, and bring a de facto

end to the ill-prepared spontaneous “July Days”.]

INVESTMENT

1. [From the point of view of capitalists and well-off people in bourgeois society:] The

outlay of money with the goal of “making” (later receiving back) more money or profit.

2. [From the strict point of view of Marxist political economy:] “The conversion of money

into productive capital.” [Marx, Capital, vol. III, ch. 6, sect. 2, (International,

p. 111; Penguin, p. 207, which has “transformation” instead of “conversion”).]

See also entries below.

INVESTMENT — Capitalist

As noted in an entry above, “the conversion of money into productive

capital” (Marx). That is, the use of profits from previous capitalist exploitation (i.e.,

surplus value) to buy new factories, machinery, raw materials,

etc., and to hire more workers to make productive use of those things, in order to produce more

commodities for sale and thus gather yet more surplus value and profits in the process of doing

so.

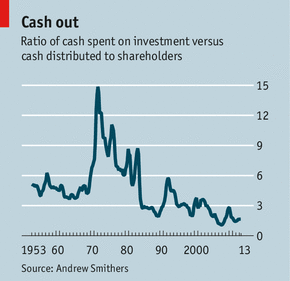

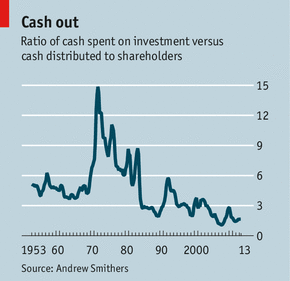

INVESTMENT — Falling Corporate Rate Of

Capitalist corporations have the option of reinvesting their profits (by building new factories

and increasing production, etc.), or by distributing those profits to shareholders in the form

of dividends, or else by just building up piles of cash on hand. During boom times, when further

profits can easily be made by building new factories and expanding production, corporations

naturally put a much greater proportion of their profits to that use. But during an overproduction

crisis, when corporations cannot even sell all that they can already produce, their strong

tendency is to avoid new productive investment, and to expand their dividends to shareholders

or to build up their excess cash in company bank accounts and/or engage in financial speculations.

Capitalist corporations have the option of reinvesting their profits (by building new factories

and increasing production, etc.), or by distributing those profits to shareholders in the form

of dividends, or else by just building up piles of cash on hand. During boom times, when further

profits can easily be made by building new factories and expanding production, corporations

naturally put a much greater proportion of their profits to that use. But during an overproduction

crisis, when corporations cannot even sell all that they can already produce, their strong

tendency is to avoid new productive investment, and to expand their dividends to shareholders

or to build up their excess cash in company bank accounts and/or engage in financial speculations.

In the graph at the right, we see how the ratio

of corporate reinvestment of profits to the dividend distributions has declined in a major way

since the beginnings of the current U.S. and world capitalist overproduction crisis in the early

1970s. The continuing decline is especially pronounced over the past decade or two, which includes

the period of the “Great Recession”. Bourgeois publications

such as the Economist claim that this low and still falling rate of reinvestment is due to

extraneous factors, such as incorrect “incentives” given to corporate managers. But the real

explanation is much simpler: It makes no sense to build new factories when you can’t fully make use

of all those you already have.

See also entries below.

INVESTMENT — Weak (Bourgeois “Explanations” For)

How do bourgeois economists explain the very weak and falling rates of capitalist investment at

the present time? Of course they rarely recognize or admit that capitalism has any inherent flaw

that leads to this result (and to outright financial and economic crises)! So they must cook up

all kinds of other strange theories. See the following summation of one recent paper by bourgeois

economists for an example of this.

“We document that the use of factors such as software, intellectual property,

brand, and innovative business processes, collectively known as ‘intangible capital’ can

explain much of the weakness in physical capital investment since 2000. Moreover, intangibles

have distinct economic features compared to physical capital. For example, they are scalable

(e.g., software) though some also have legal protections (e.g., patents or copyrights). These

characteristics may have enabled the rise in industry concentration over the last two decades.

Indeed, we show that the rise in intangibles is driven by industry leaders and coincides with

increases in their market share and hence, rising industry concentration. Moreover, intangibles

are associated with at least two drivers of rising concentration: market power and productivity

gains. Productivity gains derived from intangibles are strongest in the Consumer sector, while

market power derived from intangibles is strongest in the Healthcare sector. These shifts have

important policy implications, since intangible capital is less interest-sensitive and less

collateralizable than physical capital, potentially weakening traditional transmission mechanisms.

However, these shifts also create opportunities for policy innovation around new market mechanisms

for intangible capital.” —Nicolas Crouzet & Janice C. Eberly, “Understanding Weak Capital

Investment: the Role of Market Concentration and Intangibles”, NBER Working Paper No. 25869,

May 2019.

[It is of course true that “market

concentration” (otherwise known as monopoly or oligopoly) can intensify slowdowns in the rate of

new capital investment. The more monopoly in a capitalist economy, the more moribund it is.

However, in this recent “globalist” era there has actually been more competition—at least

internationally—and not less. And some of the weakest industries have been the traditional ones

such as steel and automobiles, where overproduction is most glaring. Thus the claim that

software and other “intangible capital” are a major cause of the investment slowdown is way off

base. The real cause is the traditional explanation that Marx established a century and a half

ago: it makes no sense to expand production further when there is no sufficient market for what

is already being produced. —S.H.]

INVESTMENT STRIKE

A refusal to invest in productive capital (factories, machinery, etc.) by the capitalists who

have plenty of money available to do so. Since investment is the means by which capitalists

expand their wealth and power, why would they ever slow down or halt their further investment?

Two explanations for why this can sometimes happen are:

1) For temporary political reasons, such as

to force the collapse of a social-democratic or other

reformist government which the capitalists perceive as being insufficiently supportive of

their interests;

2) And much more commonly and importantly, because

of a serious overproduction crisis in which large numbers

of capitalists do not see any profitable investment opportunities because they already have many

factories which are partially or completely idle.

“Rising income inequality since the 1980s in the United States has generated a

substantial increase in saving by the top of the income distribution, which we call the saving

glut of the rich. The saving glut of the rich has been as large as the global saving glut, and

it has not been associated with an increase in investment. Instead, the saving glut of the rich

has been linked to the substantial dissaving and large accumulation of debt by the non-rich.

Analysis using variation across states shows that the rise in top income shares can explain

almost all of the accumulation of household debt held as a financial asset by the household

sector. Since the Great Recession, the saving glut of the rich has been financing government

deficits to a greater degree.” —Atif R. Mian, Ludwig Straub, and Amir Sufi (bourgeois

economists), in the summary of their article “The Saving Glut of the Rich and the Rise in

Household Debt”, NBER Working Paper No. 26941, April 2020.

[The authors seem to be saying both that

the growing inequality in American society (resulting from who-knows-what!?) causes the

“savings glut” of the rich, and that this in turn causes the growing debt of the “non-rich”

(formerly known as “the poor”). These claims are not correct; correlation is not cause and

effect! The savings glut of the rich results from the major long-developing capitalist

overproduction crisis which means that it no longer

makes any sense for the capitalists to invest in order to substantially increase production,

since they can’t find markets for all the commodities produced in their existing factories.

Similarly, the growing debt of the working class and poor is not the result of the mere fact that

the rich don’t know what to do with all their savings; even during capitalist booms, before any

overproduction crisis begins to develop, the working class is still quite impoverished, certainly

in comparison with the bourgeoisie.

However the open acknowledgement by

bourgeois economists that there actually is a savings glut of the rich says something

important about just how extreme the overproduction crisis is becoming. According to

long-established bourgeois theory (“Say’s Law”) generalized gluts

of either commodities or opportunities for investment in production should be “impossible”!

When even bourgeois theorists recognize that the rich are “failing to invest” in production,

then the financial/economic situation is indeed getting very serious. —S.H.]

“INVISIBLE HAND”

The absurd idea that the public interest is best served if everyone looks out only for their

own private interests, and that the “public good” is somehow mysteriously generated out of

all that private selfishness by some “invisible hand”!

“But it is only for the sake of profit that any man employs a capital in

the support of industry...

“As every individual, therefore,

endeavours as much as he can both to employ his capital in the support of domestic

industry, and so to direct that industry that its produce may be of the greatest value;

every individual necessarily labours to render the annual revenue of the society as great

as he can. He generally, indeed, neither intends to promote the public interest, nor knows

how much he is promoting it. By preferring the support of domestic to that of foreign

industry, he intends only his own security; and by directing that industry in such a

manner as its produce may be of the greatest value, he intends only his own gain, and he

is in this, as in many other cases, led by an invisible hand to promote an end which was

no part of his intention. Nor is it always the worse for the society that it was no part

of it. By pursuing his own interest he frequently promotes that of the society more

effectually than when he really intends to promote it. I have never known much good done

by those who affected to trade for the public good. It is an affectation, indeed, not

very common among merchants, and very few words need be employed in dissuading them from

it.” —Adam Smith, The Wealth of Nations (1776), Book IV, Chapter II, (Modern Library,

1937), p. 423.

Dictionary Home Page and Letter Index

MASSLINE.ORG Home Page

Capitalist corporations have the option of reinvesting their profits (by building new factories

and increasing production, etc.), or by distributing those profits to shareholders in the form

of dividends, or else by just building up piles of cash on hand. During boom times, when further

profits can easily be made by building new factories and expanding production, corporations

naturally put a much greater proportion of their profits to that use. But during an overproduction

crisis, when corporations cannot even sell all that they can already produce, their strong

tendency is to avoid new productive investment, and to expand their dividends to shareholders

or to build up their excess cash in company bank accounts and/or engage in financial speculations.

Capitalist corporations have the option of reinvesting their profits (by building new factories

and increasing production, etc.), or by distributing those profits to shareholders in the form

of dividends, or else by just building up piles of cash on hand. During boom times, when further

profits can easily be made by building new factories and expanding production, corporations

naturally put a much greater proportion of their profits to that use. But during an overproduction

crisis, when corporations cannot even sell all that they can already produce, their strong

tendency is to avoid new productive investment, and to expand their dividends to shareholders

or to build up their excess cash in company bank accounts and/or engage in financial speculations.